Operation Manual

Table Of Contents

- Safety Summary

- OPERATOR’S GUIDE

- TO OUR CUSTOMERS

- ACCESSORIES

- APPEARANCE AND NOMENCLATURE

- MODE LOCK AND MODE SELECTOR KEYS

- DISPLAY

- OUTLINE OF PREPARATION PROCEDURE BEFORE

- CASHIER SIGNING OR CASHIER KEY OPERATIONS

- KEYBOARD LAYOUT

- FUNCTIONS OF EACH KEY

- DAILY OPERATION FLOW

- REGISTERING PROCEDURE AND PRINT FORMAT

- No-Sale

- Department Entry

- PLU Entry (Manual PLU Code Entry)

- PLU Price Shift Entry

- Repeat Entry

- Quantity Extension (Multiplication) for DEPTs/PLUs

- Single-Item Department or Single-Item PLU Entry

- Returned Merchandise

- Amount Discount

- Percent Discount, Percent Charge

- Store Coupon

- Vendor Coupon

- Item Correct

- Void

- All Void

- Non-Add Number Print

- Listing Capacity Open

- Tax Status Modification

- Subtotal (Sale Total Pre-taxed) Read

- VAT Calculation and Print (VAT = Value Added Tax)

- VAT Print

- Add-on Tax Calculation and Print

- Tax Exemption (for Add-on Tax Feature)

- VAT Exemption (for VAT Feature)

- Finalizing a Sale

- Multi-Tendering

- Split Tendering

- Cheque Cashing (No-sale cashing of a non-cash media)

- Special Rounding

- Denmark Rounding

- Sale Paid in Foreign Currencies

- No-Sale Exchange from Foreign Currency to Domestic Currency

- No-Sale Exchange from Domestic Currency to Foreign Currency

- Paid-Out

- Received-on-Account

- Salesperson Entry (Salesperson Sign-ON)

- Receipt-Issue/Non-Issue Selection

- Receipt Post-Issue

- Charge Posting: Previous Balance Manual Entry Type

- Journal Print (Thailand Specification)

- VAT Total Display

- Consignment Print

- Validation Print

- Remote Slip Printer (hardware option) Operation

- When a Power Failure Occurs...

- JOURNAL AND RECEIPT PAPER-END DETECTOR

- PRINTER HEAD OPEN DETECTOR

- REMOTE SLIP PRINTER MOTOR LOCK DETECTOR

- GENERAL MAINTENANCE

- SPECIFICATIONS

- MANAGER’S GUIDE

- OPERATIONS IN “MGR” MODE

- OPERATIONS IN “ - ” MODE

- READ (X) AND RESET (Z) REPORTS

- PROGRAMMING OPERATIONS

- Instructions for Programming

- Character Entries

- Condition Required for Programming Operations

- SET Mode Menu

- Time Setting or Adjustment

- Date Setting or Adjustment

- Commercial Message Programming

- Footer Message Programming

- Store Name Message Programming

- Cashier Name and Status Programming

- Department Name Programming

- Department Group Name Programming

- PLU Name Programming

- Salesperson Name Programming

- Department Table Programming

- PLU Table Programming

- Department Preset Price Setting or Changing

- PLU Preset Price Setting or Changing

- %+ and %- Preset Rate Setting

- Foreign Currency Exchange Rate Setting

- VERIFICATION OF PROGRAMMED DATA

11. REGISTERING PROCEDURE AND PRINT FORMAT EO1-11154

11.20 VAT Calculation and Print

11-13

11.20 VAT Calculation and Print (VAT = Value Added Tax)

If your ECR adopts the VAT feature, a proper tax rate has been programmed for each VAT and automatically

calculated on finalizing a sale. Since VATs are price-inclusive taxes, the price or amount entered and the

subtotal or sale total to be obtained always include the VAT amounts (if any).

By program options, the VAT amounts and the taxable totals (sale total portions subject to respective VATs) may

be printed above the sale total line on receipts. Whether the VAT amounts are printed in one consolidated line or

separate individual lines is another program option.

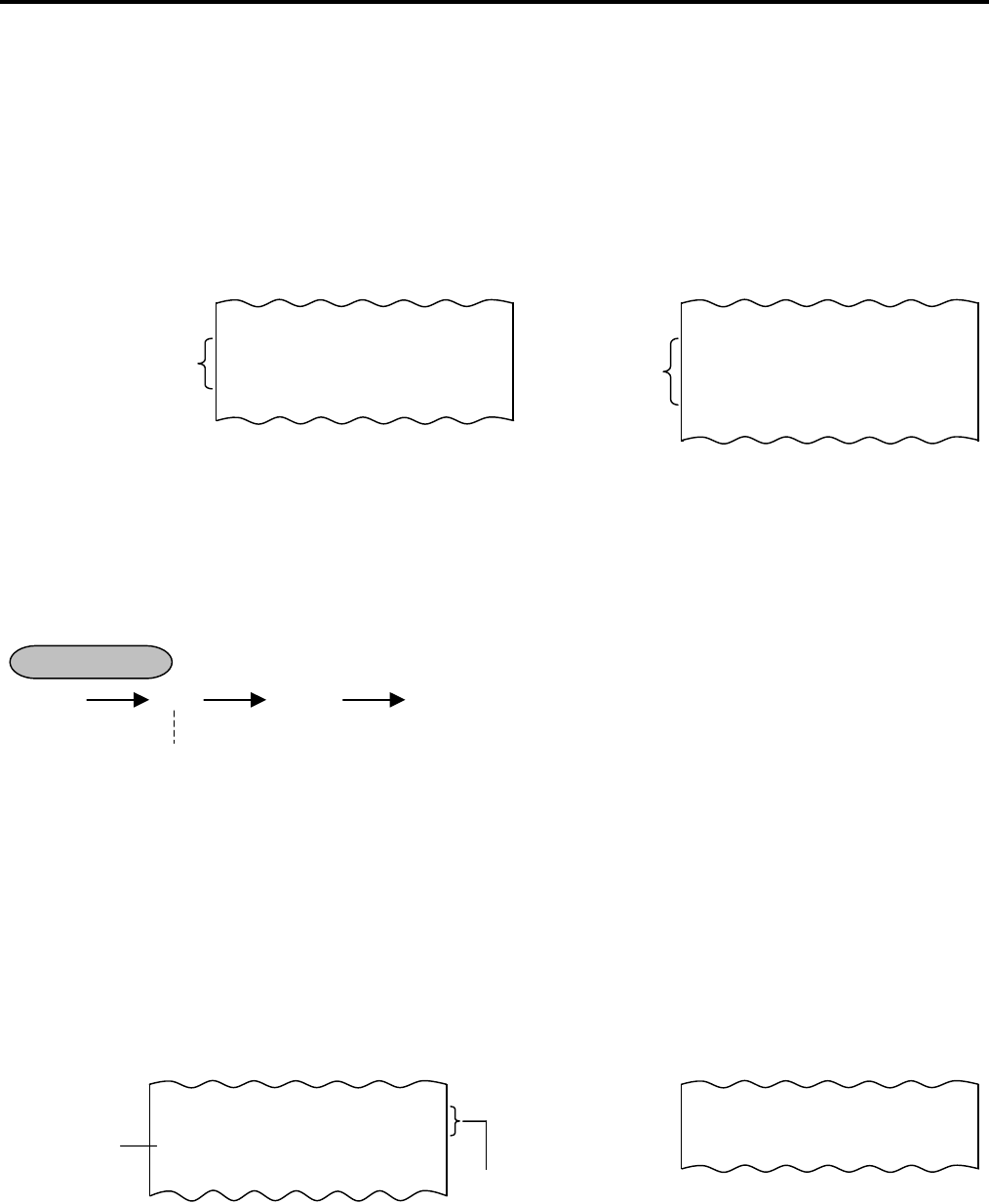

-- Receipt Print Format --

Example of Example of

Consolidated Separate Print

Print Line Lines

11.21 VAT Print

The VAT Print function is effective only when the VAT feature is selected. This operation is used to print the

details of how much VATs are collected within the current sale. The operation will print all the different VATs and

Taxable Totals.

- - - [ST] [VAT] Sale Finalization by Media Keys

11.22 Add-on Tax Calculation and Print

If your ECR adopts the Add-on Tax feature, a proper tax has been programmed for each tax and automatically

calculated on finalizing a sale. The tax amounts are printed above the sale total. The sale total always print

taxed total amount (sale total amount including taxes). When the [ST] key is depressed, the taxed total (total

with taxes) is displayed, but the subtotal (total without taxes) is printed if the option “Subtotal Print” option is

selected. Whether all taxes (Tax 1 to Tax 8) are consolidated into one line print or individually printed in separate

lines is a program option.

-- Receipt Print Format --

Example of

Consolidated

Print Line

SUBTL €7,50

TXBL1 €1,50

TXBL2 €6,00

VAT €0,92

CASH €

7,50

SUBTL €7,50

TXBL1 €1,50

VAT1 €0,14

TXBL2 €6,00

VAT €0,78

CASH €

7,50

OPERATION

Mandatory for VAT Print

VEGETABLE €1,50T

FRUIT €6,00T

TAX €1,05

CASH €

8,55

TAX1 €0,15

TAX2 €0,90

CASH €

8,55

Taxable Item

Symbol

Example o

f

Separate Print

Lines