Operation Manual

Table Of Contents

- Safety Summary

- OPERATOR’S GUIDE

- TO OUR CUSTOMERS

- ACCESSORIES

- APPEARANCE AND NOMENCLATURE

- MODE LOCK AND MODE SELECTOR KEYS

- DISPLAY

- OUTLINE OF PREPARATION PROCEDURE BEFORE

- CASHIER SIGNING OR CASHIER KEY OPERATIONS

- KEYBOARD LAYOUT

- FUNCTIONS OF EACH KEY

- DAILY OPERATION FLOW

- REGISTERING PROCEDURE AND PRINT FORMAT

- No-Sale

- Department Entry

- PLU Entry (Manual PLU Code Entry)

- PLU Price Shift Entry

- Repeat Entry

- Quantity Extension (Multiplication) for DEPTs/PLUs

- Single-Item Department or Single-Item PLU Entry

- Returned Merchandise

- Amount Discount

- Percent Discount, Percent Charge

- Store Coupon

- Vendor Coupon

- Item Correct

- Void

- All Void

- Non-Add Number Print

- Listing Capacity Open

- Tax Status Modification

- Subtotal (Sale Total Pre-taxed) Read

- VAT Calculation and Print (VAT = Value Added Tax)

- VAT Print

- Add-on Tax Calculation and Print

- Tax Exemption (for Add-on Tax Feature)

- VAT Exemption (for VAT Feature)

- Finalizing a Sale

- Multi-Tendering

- Split Tendering

- Cheque Cashing (No-sale cashing of a non-cash media)

- Special Rounding

- Denmark Rounding

- Sale Paid in Foreign Currencies

- No-Sale Exchange from Foreign Currency to Domestic Currency

- No-Sale Exchange from Domestic Currency to Foreign Currency

- Paid-Out

- Received-on-Account

- Salesperson Entry (Salesperson Sign-ON)

- Receipt-Issue/Non-Issue Selection

- Receipt Post-Issue

- Charge Posting: Previous Balance Manual Entry Type

- Journal Print (Thailand Specification)

- VAT Total Display

- Consignment Print

- Validation Print

- Remote Slip Printer (hardware option) Operation

- When a Power Failure Occurs...

- JOURNAL AND RECEIPT PAPER-END DETECTOR

- PRINTER HEAD OPEN DETECTOR

- REMOTE SLIP PRINTER MOTOR LOCK DETECTOR

- GENERAL MAINTENANCE

- SPECIFICATIONS

- MANAGER’S GUIDE

- OPERATIONS IN “MGR” MODE

- OPERATIONS IN “ - ” MODE

- READ (X) AND RESET (Z) REPORTS

- PROGRAMMING OPERATIONS

- Instructions for Programming

- Character Entries

- Condition Required for Programming Operations

- SET Mode Menu

- Time Setting or Adjustment

- Date Setting or Adjustment

- Commercial Message Programming

- Footer Message Programming

- Store Name Message Programming

- Cashier Name and Status Programming

- Department Name Programming

- Department Group Name Programming

- PLU Name Programming

- Salesperson Name Programming

- Department Table Programming

- PLU Table Programming

- Department Preset Price Setting or Changing

- PLU Preset Price Setting or Changing

- %+ and %- Preset Rate Setting

- Foreign Currency Exchange Rate Setting

- VERIFICATION OF PROGRAMMED DATA

4. PROGRAMMING OPERATIONS EO1-11154

4.15 Department Table Programming

4-40

*1: Department Group No.

• Input a department group code (2 digits: 01 to 15), then depress the [Enter] key.

• To cancel a department group, input 0 then depress the [Enter] key.

• All departments can be programmed in a group. Negative departments are added to the group total.

*2: Preset Price

• For a preset department (preset-price department), enter a maximum of 6-digit price, and depress the

[Enter] key.

1 to 999999 (result: 0,01 to 9999,99)

• A zero-price (0,00) may be preset by entering 0 in the above operation.

• When no numeric is entered and the [Enter] key is simply depressed, the department will be an open

department (open-price department).

*3: Department Status

• The status ON or OFF is selected with the [←] and [→] keys.

• The status change between positive and negative should be performed after performing a

department/PLU daily and GT resets.

• The following shows each department status.

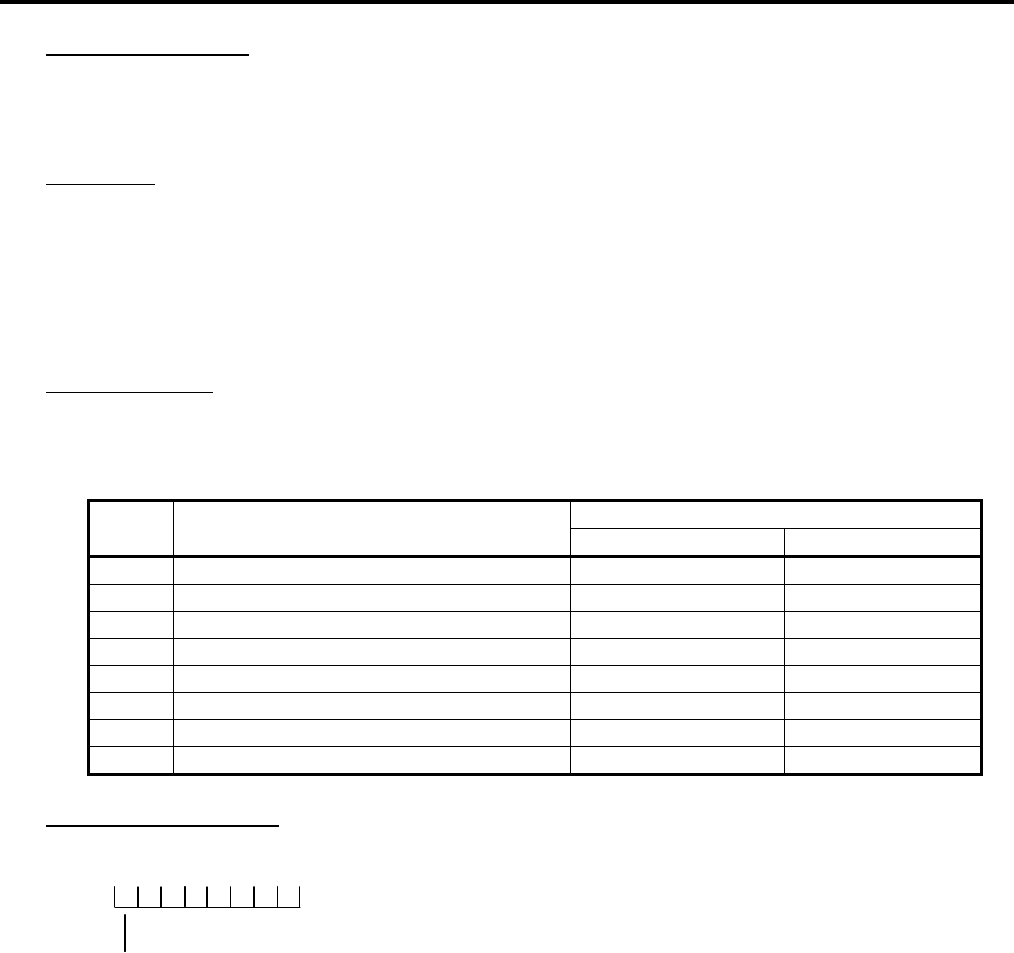

Selective Status

Status

Code

Item

ON (Y) OFF (N)

1 Single-item or Itemized Receipt Single-item Itemized

2 -- vacant --

3 Positive or Negative Department Negative Positive

4 -- vacant --

5 -- vacant --

6 -- vacant --

7 -- vacant --

8 -- vacant --

*4: VAT or Add-on Tax Status

The Tax Type should be selected from either “VAT” or “ADD-ON TAX” by the program option.

• Enter one- to eight-digit Status Codes for applicable VAT or Add-on Tax.

[Enter]

VAT or Add-on Status Type

0: Non-VAT or Non-taxable

1: VAT 1 or Tax 1

2: VAT 2 or Tax 2

3: VAT 3 or Tax 3

4: VAT 4 or Tax 4

5: VAT 5 or Tax 5

6: VAT 6 or Tax 6

7: VAT 7 or Tax 7

8: VAT 8 or Tax 8

• A combination of VAT and Add-on tax statuses is not possible.

(More than one code can be entered for

combining Tax1 to Tax8 taxable status.

For example, enter 12 to select VAT 1 and VAT

2 (or Tax 1 and Tax 2) taxable status.)