User's Manual

Table Of Contents

- Quick-Start

- Precautions when Using this Product

- Contents

- Getting Acquainted— Read This First!

- Chapter 1 Basic Operation

- Chapter 2 Manual Calculations

- Chapter 3 List Function

- Chapter 4 Equation Calculations

- Chapter 5 Graphing

- 5-1 Sample Graphs

- 5-2 Controlling What Appears on a Graph Screen

- 5-3 Drawing a Graph

- 5-4 Storing a Graph in Picture Memory

- 5-5 Drawing Two Graphs on the Same Screen

- 5-6 Manual Graphing

- 5-7 Using Tables

- 5-8 Dynamic Graphing

- 5-9 Graphing a Recursion Formula

- 5-10 Changing the Appearance of a Graph

- 5-11 Function Analysis

- Chapter 6 Statistical Graphs and Calculations

- Chapter 7 Financial Calculation (TVM)

- Chapter 8 Programming

- Chapter 9 Spreadsheet

- Chapter 10 eActivity

- Chapter 11 System Settings Menu

- Chapter 12 Data Communications

- Appendix

20070201

BAL 0 = PV ( INT 1 = 0 and PRN 1 = PMT at beginning of installment term)

u Converting between the nominal interest rate and effective interest rate

The nominal interest rate ( I % value input by user) is converted to an effective interest rate

( I % ' ) for installment loans where the number of installments per year is different from the

number of compound interest calculation periods.

The following calculation is performed after conversion from the nominal interest rate to the

effective interest rate, and the result is used for all subsequent calculations.

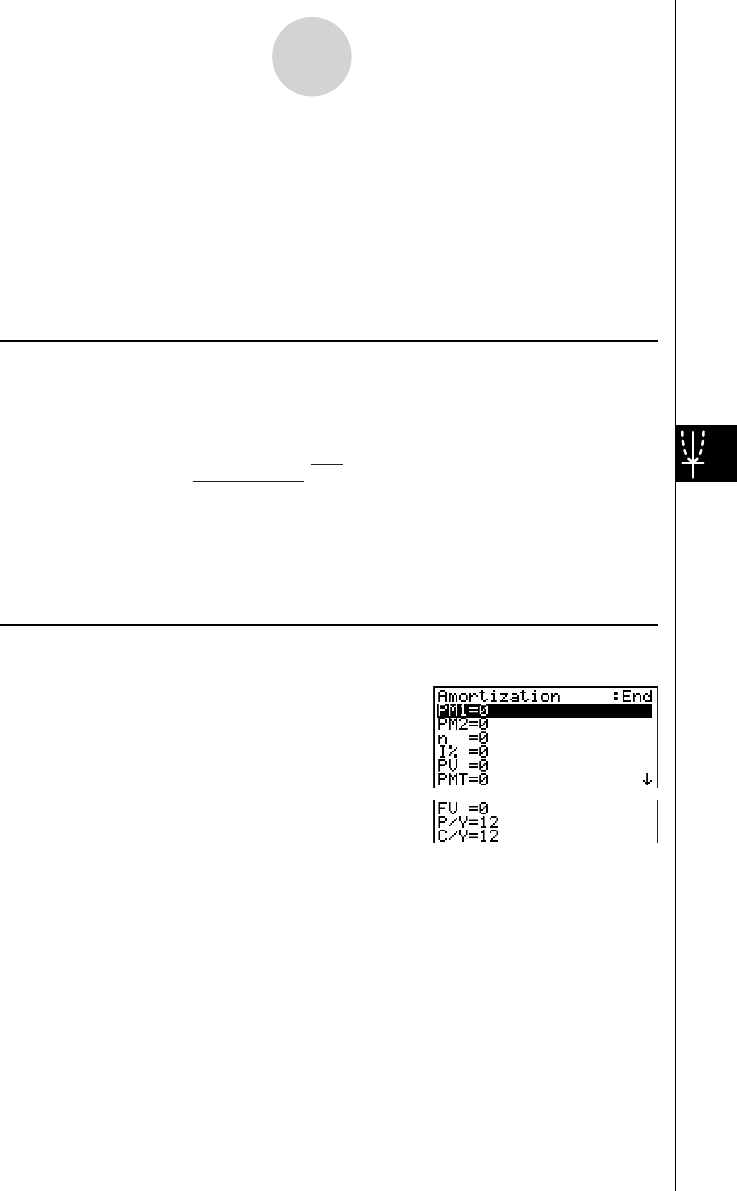

Press 4 (AMT) from the Financial 1 screen to display the following input screen for

amortization.

4 (AMT)

PM1 .............................. fi rst installment of installments 1 through n

PM2 .............................. second installment of installments 1 through

n

n .................................. installments

I % ................................ interest rate

PV ............................... principal

PMT ............................ payment for each installment

FV ............................... balance following fi nal installment

P / Y .............................. installments per year

C / Y .............................. compoundings per year

a : INT

PM1

= I BAL

PM1–1

× i I × (PMT sign)

b : PRN

PM1

= PMT + BAL

PM1–1

× i

c : BAL

PM2

= BAL

PM2–1

+ PRN

PM2

d :

Σ

PRN = PRN

PM1

+ PRN

PM1+1

+ … + PRN

PM2

e :

Σ

INT = INT

PM1

+ INT

PM1+1

+ … + INT

PM2

PM2

PM1

PM2

PM1

a : INT

PM1

= I BAL

PM1–1

× i I × (PMT sign)

b : PRN

PM1

= PMT + BAL

PM1–1

× i

c : BAL

PM2

= BAL

PM2–1

+ PRN

PM2

d :

Σ

PRN = PRN

PM1

+ PRN

PM1+1

+ … + PRN

PM2

e :

Σ

INT = INT

PM1

+ INT

PM1+1

+ … + INT

PM2

PM2

PM1

PM2

PM1

I%' =

I%

(1+ ) –1

[C / Y ]

[P / Y ]

100 × [C / Y ]

{ }

×

100

I%' =

I%

(1+ ) –1

[C / Y ]

[P / Y ]

100 × [C / Y ]

{ }

×

100

i = I%'÷100 i = I%'÷100

7-5-2

Amortization